Whoa! I still get a little buzz when a new farm launches on Solana. It’s fast, cheap, and full of promise. But my instinct says tread carefully—high yields often hide high complexity. Initially I thought the hardest part was choosing a pool, but actually my biggest headaches came from tracking rewards and untangling transaction history when things went sideways. I’m biased toward wallets that make auditing simple, and that matters more than shiny APR numbers.

Okay, so check this out—yield farming on Solana is not magic. You provide liquidity or stake tokens, protocols reward you with yield (or governance tokens), and those rewards compound or get swapped back into more LP tokens if you choose. Medium-sized risk, sometimes big returns. On one hand you can earn very very high percentages for short windows, though actually those numbers fluctuate wildly and often include token emissions that dilute value over time. Hmm… something felt off the first time I chased a 300% APR without reading the fine print.

Here’s the thing. There are a few practical layers to think about: the protocol mechanics, the wallet handling your keys and transaction history, and the actual bookkeeping—how you track what you’ve earned versus what you’ve spent. If you ignore any of those three, you’ll miscalculate risk or tax liabilities. For most people in the Solana ecosystem, you want a wallet that makes staking, approvals, and transaction history clear and exportable.

How yield farming on Solana typically works

Short version: deposit, stake, earn. Really? Yes, but with dozens of little caveats. Liquidity pools pair two assets in an AMM like Raydium, Orca, or Saber. You deposit proportional amounts and receive LP tokens that represent your share. Those LP tokens can be staked in a farm contract to earn extra rewards. Single-sided staking exists too—stake one token rather than pair—so impermanent loss may be less of a factor depending on setup.

APRs you see on dashboards usually assume constant price and no change in pool size, which rarely holds true. That’s why I always check token emission schedules and read the protocol’s docs before trusting headline rates. Also, smart contract risk is real—audits help but don’t guarantee safety. Oh, and by the way, farming strategies that rely on continual compounding need frequent transactions; on Solana the fees are small, but the noise in your transaction history increases fast.

One practical pattern I use: prioritize farms with clear reward token economics, decent TVL, and active developer/community support. If the project’s incentives disappear, so does your yield—sometimes overnight. Initially I chased short-term incentives, but then I learned to favor sustainable yield sources when I wanted longer-term positions.

Wallets and transaction history: why they matter

My wallet is my ledger and my accountability system. A messy wallet UI that hides transaction details makes it easy to miss approvals, airdrop taxes, or phantom token swaps. Seriously? Yep. That’s why I recommend using a wallet that shows staking history, contract interactions, and that can pair with hardware wallets for signing critical txs.

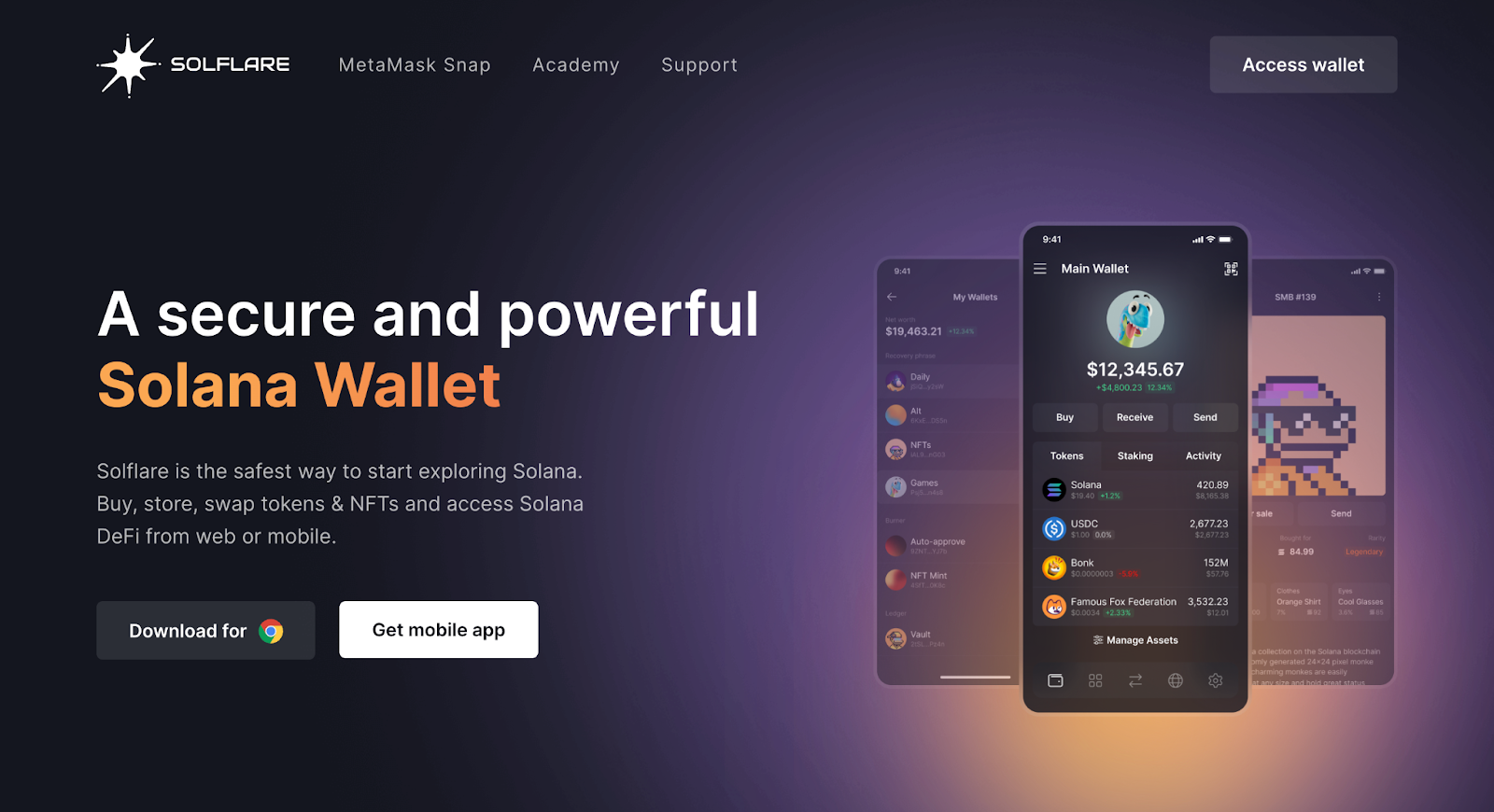

For Solana users I often point friends to solflare because it balances usability and on-chain transparency—especially when you need to check staking operations or export basic history. With a wallet like that, you can more easily tell whether rewards were auto-compounded, paid out, or left sitting as a separate token. I’m not saying it’s perfect—no wallet is—but it’s practical for people doing DeFi and staking on Solana.

Another tip: use explorers like Solscan or the Solana Explorer to verify raw transactions if your wallet UI looks off. If you see a token you don’t recognize, trace the transaction back to its program; sometimes airdrops or scam tokens are just noise, though they can be used in phishing attempts. Keep your ledger attached for confirmations when unstaking large positions, and always double-check the recipient address during transfers—copy-paste errors are more common than you’d think.

Keeping clean transaction records

Taxes and audits don’t wait. So keep records from day one. Export CSVs when possible, or keep screenshots with timestamps. You want a chronological record of deposits, withdrawals, swaps, and farm enrollments. This makes it easier to compute realized gains versus accrued rewards. On top of that, labeling addresses in your personal notes helps when you revisit an old pool months later and wonder “what was that?”

When I started farming, I was sloppy. Honestly, that part bugs me. I had to reconstruct months of activity after the fact. Fun? Not really. Now I maintain a simple spreadsheet: date, tx signature, protocol, action, tokens in/out, fees, and notes. It takes five minutes per major move and saves a headache later. Also, if you ever need to prove airdrop eligibility or dispute a contract action, a well-kept log is your friend.

Be aware of cross-program interactions that can hide multiple actions under a single transaction hash. Solana transactions aggregate instructions, so one click can do swaps, stake, and claim—so read the transaction details. Initially I underestimated how many sub-instructions a single “farm” click might trigger, but now I scan instruction lists before approving large or unfamiliar transactions.

Risk management and practical checks

Risk is multifaceted: smart contract bugs, rug pulls, impermanent loss, and simple human error. Manage them with diversification, position sizing, and frequent reviews. Small positions while you test a protocol; increase once comfortable. And never stake more than you can afford to be illiquid for months—remember lockups and cooldowns.

Also watch for permit/approval mechanics: some contracts ask for token approvals that can be indefinite. Revoke approvals when you’re done, or use wallets that allow fine-grained permissions. If something smells like a phishing site, close your browser and check the contract address in a trusted explorer. My instinct saved me once from approving a malicious spending allowance; my gut said “no” and I’m glad I listened.

Finally, consider hardware wallet integration. Even if your keys live in a software wallet, signing high-value operations with a Ledger or similar device reduces risk. I’m not 100% sure every casual farmer needs a hardware device, but for mid-to-high balances it’s worth the comfort.

FAQ: Quick answers from the field

How do I track yield across multiple farms?

Use your wallet’s transaction export where available, supplement with on-chain explorers, and maintain a simple spreadsheet. Periodically reconcile claimed rewards against protocol dashboards so you spot discrepancies early.

Can I see my full transaction history in a wallet?

Many wallets show most interactions but might abstract multi-instruction transactions. If you need raw detail, check Solana explorers with your transaction signature. Also, exporting CSVs or connecting to trusted portfolio trackers helps aggregate across many farms.

Is staking on Solana safe?

Staking itself is relatively mature, especially with reputable validators, but risks remain—validator slashing (rare on Solana), misconfigurations, or UX mistakes. For DeFi farms, add smart contract risk and token economics to that list. Use tried-and-true validators and vetted protocols when possible.

Which wallet do you actually use?

I frequently use solflare for Solana staking and DeFi because it strikes a good balance between usability and transparency. It’s not the end-all, but it’s solid for people who want clearer staking workflows and transaction visibility.